Understanding GIC’s latest results: 52.4% returns over past 5 years, 272.7% over 2 decades

As it is today, GIC has grown its portfolio by half in the past five, nearly doubled over ten and almost tripled it over twenty years.

Another VP article in quick succession, as GIC has just published its annual report and it’s as ever, very conservative in how the data is presented. This is typical of the corporation, which focuses on highlighting the lowest, real (i.e. inflation adjusted) figures.

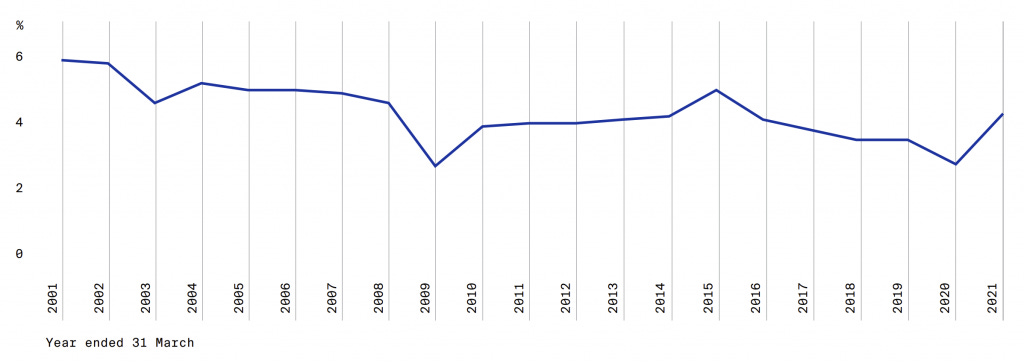

As you can see in this chart, it appears to be quite unimpressive:

It seems to be part of the overall policy to not brag about the success in investing money held as reserves, so as not to attract unwanted attention from both abroad and within the country (where many might start asking why the investments cannot be more generously spent among the people).

GIC reported that its rolling annualised 20-year real rate of return has reached 4.3 per cent, up from 2.7 per cent reported last year at the height of the pandemic-induced stock market collapse.

It may not look remarkable at all, but there’s a bit we have to unpack before we can compare the figures with anything else.

Investments are typically evaluated by their nominal rate of return but, as I said, GIC takes a conservative approach in correcting its numbers for inflation. Once we roll back this adjustment, we can see what’s really going on.

How have these figures added up to 50 or nearly 300%?