Temasek returns only 24.5%, while major stock markets gain 50%: Is the company struggling?

Slow and steady wins the investment race. Temasek's portfolio is more resilient, and profitable, in the long run.

Last week, an opinion published on a Straits Times forum on July 17, alleging that Temasek’s record growth in portfolio value is actually low by global standards, began circulating in some Singaporean media outlets.

The question, asked by a certain Alfred Chan, is certainly valid. While returns of 24.5 per cent look good, why are they less than half of what global stock markets have achieved in the same time?

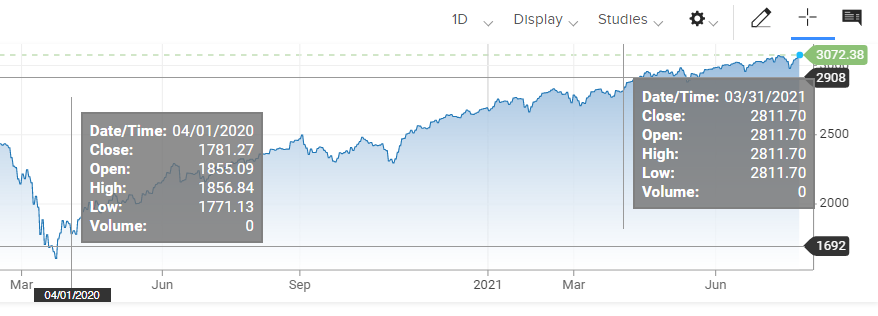

MSCI World Index is a useful benchmark of their performance, tracking indexes across 23 major economies, providing a summary into the performance of the developed world. Between 1 April 2020 and 31 March 2021 — the same period Temasek reported — it has grown by 51 per cent.

Is Temasek lagging behind? Is Singapore’s most aggressive fund being mismanaged? Would the money be better spent if it was simply put into some index fund, without overheads, including likely high salaries for its management?

Not quite.

You see, single year returns tend to be very misleading — particularly when they are framed in ways that support a specific point, distracting from broader perspective.

So, how is Temasek really doing?